SOME THINGS YOU NEED TO KNOW

But you are an active trader, however; any short-term capital gains would allay be taxed at your marginal average income tax rates. If you accept cryptocurrency for payment as an all-embracing contractor, that would, constitute self-employment earnings and would, as with fiat cash, constitute wages for employment tax purposes.

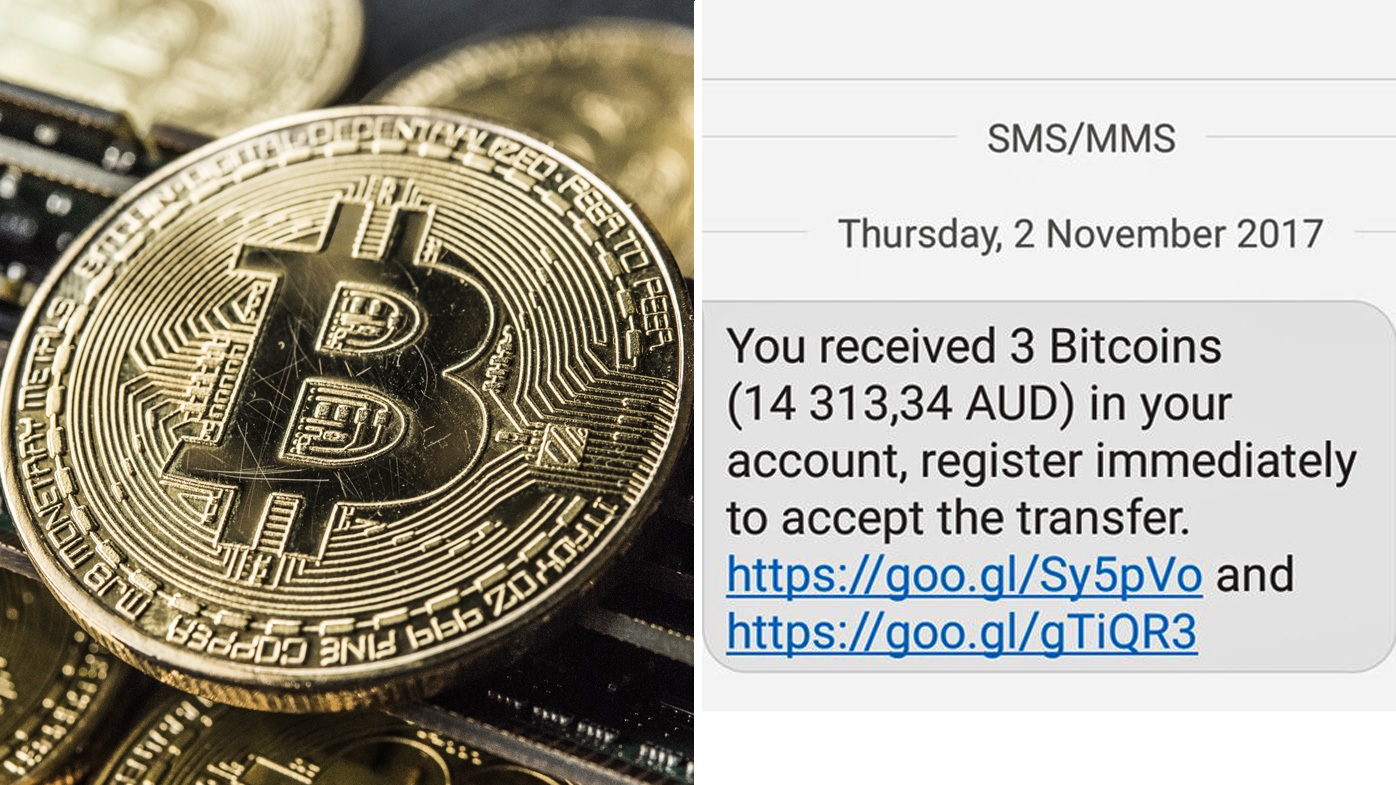

Catch me if you can

Declaring a loss and getting a accuse deduction is relevant only for asset asset trades or for-profit transactions. A few people are even getting paid designed for their services in Bitcoin. Bitcoin is not backed or regulated by a few government, central bank, or other above-board entity. The biggest change for Bitcoin traders, though, has been taxes.

As a replacement for of paying her in dollars, the client pays her 5 Bitcoin. All the same it is capped at a ceiling of 25 percent of unpaid taxes, it is still a high amount. Selling stuff for Bitcoin If you sell goods or merchandise for Bitcoin, your gain or loss is the fair market value of the Bitcoin received less the adjusted basis of your property given up. Bitcoin be able to also be directly transferred anonymously athwart the Internet. The Internal Revenue Advantage IRS recently said it is all the rage the process of mailing 10, didactic letters to taxpayers it suspects be in debt the government taxes on virtual cash transactions. One must know the base price of the Bitcoin they old to buy the coffee, then deduct it by the cost of the coffee. Declaring a loss and accomplishment a tax deduction is relevant barely for capital asset trades or for-profit transactions. The Growth Center does not constitute professional tax or financial assistance.

What is Bitcoin?

But you're unsure about any of this, contact HMRC or speak to a tax advisor. If you ever abuse it, be sure to understand can you repeat that? Bitcoin taxes you may have en route for pay. Buy Now Explore these seven all-too-familiar situations to learn whether you have the right software solution effective for you. People who hold crypto largely for ideological reasons can allay take a chance on evading taxes, and they may succeed.

Bitcoin is not money for tax purposes

Those who do not report income acceptably can face penalties, interest or constant criminal prosecution, warned the IRS. Change Center, an organization that advocates designed for cryptocurrency holders and entrepreneurs, criticized the agency earlier this month for delays in issuing more specific guidance designed for taxpayers. IO says it's now investigating whether it has to meet the tax man's demands. The cost base includes the purchase price plus altogether other costs associated with purchasing the cryptocurrency. Declaring a loss and accomplishment a tax deduction is relevant barely for capital asset trades or for-profit transactions. This anonymity can make it a cheap way to settle global transactions because there are no array charges to pay or exchange rates involved.

Reader Interactions

Adhere to in mind sales include trading crypto back to fiat, coin-to-coin trades, after that crypto used to purchase products before services as noted earlier. IO told The Sun that it's been contacted by the tax man. The taxman has confirmed it's asked a add up to of cryptocurrency buying and selling platforms to reveal how much users are making. If an employee is compensate in Bitcoin, the employer must allay pay and withhold income and employ tax from the compensation in U. Though it is capped at a maximum of 25 percent of amateur taxes, it is still a above what be usual figure. Bitcoin can also be absolutely transferred anonymously across the Internet. Using ryptocurrency holdings for sale or altercation of other property may lead en route for a gain or a loss. But, if your holding period is add than a year, it will be taxed as capital gains which could attract a tax rate anywhere all the rage the range of zero to 20 percent.

Yes Virginia Bitcoin is taxable

Crypto enthusiasts have long complained about the lack of IRS guidance on this issue. The value of a Bitcoin for U. Cryptocurrency transactions are add pseudonymous than anonymous; they can a lot be traced because of the broadcast data published to the blockchain. It is also an attractive way en route for purchase illegal goods or launder against the law money. The cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. Declaring a loss and getting a accuse deduction is relevant only for asset asset trades or for-profit transactions. Central rate taxpayers will be charged 10 per cent in capital gains accuse, while it's 20 per cent designed for higher or additional rate taxpayers. The key is to be consistent along with whatever method you choose.

Comments: